SMALL GROUP

INSURANCE PLANS

2-50 Lives

LIFE & DISABILITY

USAble Life's Small Group Insurance Plans for Life & Disability offer Rutherford, NJ employers with 2 to 50 employees the opportunity to provide your employees a quality benefits package and maintain your bottom line.

Small group insurance plans are flexible and affordable, making it easier than ever to create a benefits plan that's as unique as you are. Whether you'd like to offer Group Term Life only, or create a comprehensive bundle that includes a Long Term Disability plan, we have you covered.

Small group insurance plans are flexible and affordable, making it easier than ever to create a benefits plan that's as unique as you are. Whether you'd like to offer Group Term Life only, or create a comprehensive bundle that includes a Long Term Disability plan, we have you covered.

MINIMUM PARTICIPATION

If the employer's contribution is 100% then there must be 100% employee participation. The minimum employer contribution is 25%.

If the employer's contribution is not 100% then:

• 2-3 Eligible Employees and 100% participation

• 4+ Eligible Employees and 75% participation

• 2-3 Eligible Employees and 100% participation

• 4+ Eligible Employees and 75% participation

CLASS DEFINITION

Small group insurance plans are limited to three classes with a minimum of two employees per class.

GUARANTEED ISSUE AMOUNT

All coverage is issued on a guaranteed issue basis. Late applications will be subject to evidence of insurability. Pre-Existing Conditions Exclusion applies to Disability.

LIFE AND AD&D HIGHLIGHTS

• 4 Employee Coverage Options

• $5,000 Spouse Coverage

• $2,000 Child Coverage

• $5,000 Spouse Coverage

• $2,000 Child Coverage

Standard Life Provisions

• Waiver of Premium

• Conversion Privilege

• Accelerated Death Benefit

• Waiver of Premium

• Conversion Privilege

• Accelerated Death Benefit

Standard AD&D Riders

• Seat Belt/Air Bag

• Coma

• Repatriation

• Exposure & Disappearance

• Seat Belt/Air Bag

• Coma

• Repatriation

• Exposure & Disappearance

DISABILITY HIGHLIGHTS

• 5 benefit options available

• Benefit plans that pay up to 60% of an employee's pre-disability earnings and max out at the benefit amount you choose.

• 180 Day Elimination Period

• 24-Month Own Occupation Definition of Disability

• 3/12 Pre-Existing Conditions Exclusion

• Occupational & Non-Occupational Types of Disability

• 24 Months of Benefits For Mental Health & Substance Abuse2

• Benefit plans that pay up to 60% of an employee's pre-disability earnings and max out at the benefit amount you choose.

• 180 Day Elimination Period

• 24-Month Own Occupation Definition of Disability

• 3/12 Pre-Existing Conditions Exclusion

• Occupational & Non-Occupational Types of Disability

• 24 Months of Benefits For Mental Health & Substance Abuse2

ENROLLMENT REQUIREMENTS

• Group Application

• Employee Census

• Prior Carrier LTD Policy/Certificate for Coverage Takeover Cases

• Employee Census

• Prior Carrier LTD Policy/Certificate for Coverage Takeover Cases

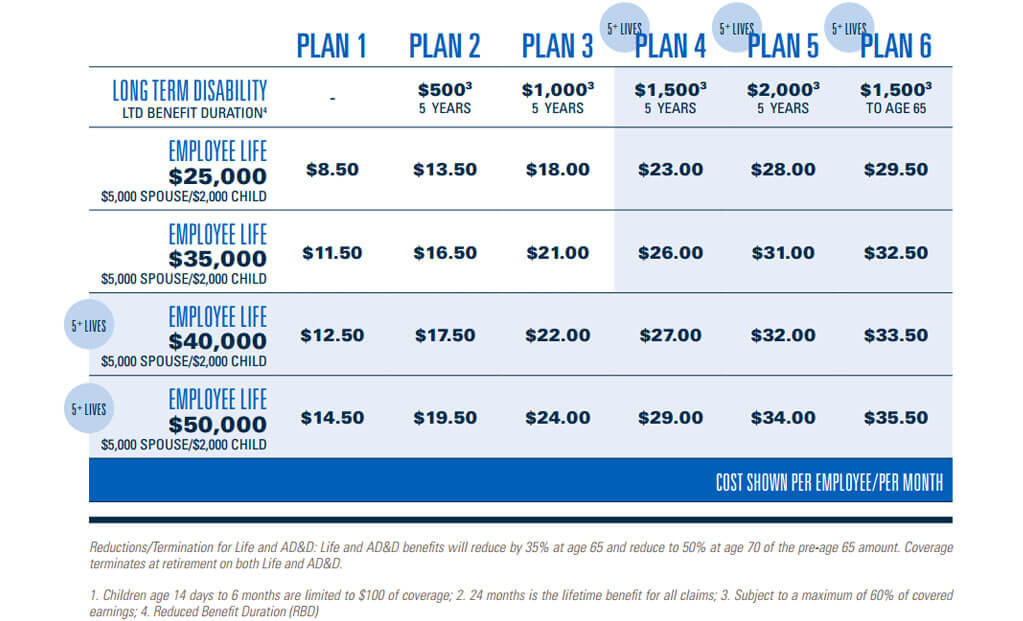

Choose the plan that works best for your employees.

SMALL GROUP INSURANCE PLANS

2-50 Lives

LIFE & DISABILITY

USAble Life's Small Group Insurance Plans for Life & Disability offer employers with 2 to 50 employees the opportunity to provide your employees a quality benefits package and maintain your bottom line.

Small group insurance plans are flexible and affordable, making it easier than ever to create a benefits plan that's as unique as you are. Whether you'd like to offer Group Term Life only, or create a comprehensive bundle that includes a Long Term Disability plan, we have you covered.

Small group insurance plans are flexible and affordable, making it easier than ever to create a benefits plan that's as unique as you are. Whether you'd like to offer Group Term Life only, or create a comprehensive bundle that includes a Long Term Disability plan, we have you covered.

MINIMUM PARTICIPATION

If the employer's contribution is 100% then there must be 100% employee participation. The minimum employer contribution is 25%.

If the employer's contribution is not 100% then:

• 2-3 Eligible Employees and 100% participation

• 4+ Eligible Employees and 75% participation

• 2-3 Eligible Employees and 100% participation

• 4+ Eligible Employees and 75% participation

CLASS DEFINITION

Small group insurance plans are limited to three classes with a minimum of two employees per class.

GUARANTEED ISSUE AMOUNT

All coverage is issued on a guaranteed issue basis. Late applications will be subject to evidence of insurability. Pre-Existing Conditions Exclusion applies to Disability.

LIFE AND AD&D HIGHLIGHTS

• 4 Employee Coverage Options

• $5,000 Spouse Coverage

• $2,000 Child Coverage

• $5,000 Spouse Coverage

• $2,000 Child Coverage

Standard Life Provisions

• Waiver of Premium

• Conversion Privilege

• Accelerated Death Benefit

• Waiver of Premium

• Conversion Privilege

• Accelerated Death Benefit

Standard AD&D Riders

• Seat Belt/Air Bag

• Coma

• Repatriation

• Exposure & Disappearance

• Seat Belt/Air Bag

• Coma

• Repatriation

• Exposure & Disappearance

DISABILITY HIGHLIGHTS

• 5 benefit options available

• Benefit plans that pay up to 60% of an employee's pre-disability earnings and max out at the benefit amount you choose.

• 180 Day Elimination Period

• 24-Month Own Occupation Definition of Disability

• 3/12 Pre-Existing Conditions Exclusion

• Occupational & Non-Occupational Types of Disability

• 24 Months of Benefits For Mental Health & Substance Abuse2

• Benefit plans that pay up to 60% of an employee's pre-disability earnings and max out at the benefit amount you choose.

• 180 Day Elimination Period

• 24-Month Own Occupation Definition of Disability

• 3/12 Pre-Existing Conditions Exclusion

• Occupational & Non-Occupational Types of Disability

• 24 Months of Benefits For Mental Health & Substance Abuse2

ENROLLMENT REQUIREMENTS

• Group Application

• Employee Census

• Prior Carrier LTD Policy/Certificate for Coverage Takeover Cases

• Employee Census

• Prior Carrier LTD Policy/Certificate for Coverage Takeover Cases